Government

Commercial Construction Outlook Buoyed by Government Spending in 2023

by Evan Hill | March 8, 2023

Steady backlogs reported by many construction firms in the latter half of 2022 have led industry watchers to predict continued growth in construction spending for 2023.

Although many continue to closely watch the Federal Reserve as it raises interest rates to tame inflation – a move that could cast a damper on projections as we move into 2023, they point to continued government investments in the construction sector as an underlying positive boost.

The Associated Builders and Contractors’ Construction Backlog report stood at 8.8 months in October, according to an ABC member survey conducted Oct. 20 to Nov. 4. That was down slightly from September’s 9.0 backlog.

“While the industry continues to gain strength from significant funding for public work, pandemic-induced behavioral shifts—including remote work and online business meetings as well as surging borrowing costs—are translating into meaningful declines in backlog in commercial and institutional segments,” ABCs’ chief economist Anirban Basu said in the most recent press release.

“With borrowing costs likely to increase during the coming months and materials prices set to remain elevated, industry momentum could easily downshift further in 2023,” he said. “But … there is still underlying momentum in the U.S. economy. Contractor survey data indicate that while backlog declined in October, it remains reasonably healthy. Moreover, the average contractor continues to expect sales, staffing and margins to grow over the next six months. Time will tell whether this lingering optimism is justified.”

While the overall construction outlook for 2023 saw a slight backlog decline, construction in many categories has jumped considerably in the past year, and many industry pundits expect that to continue, at least in the short term.

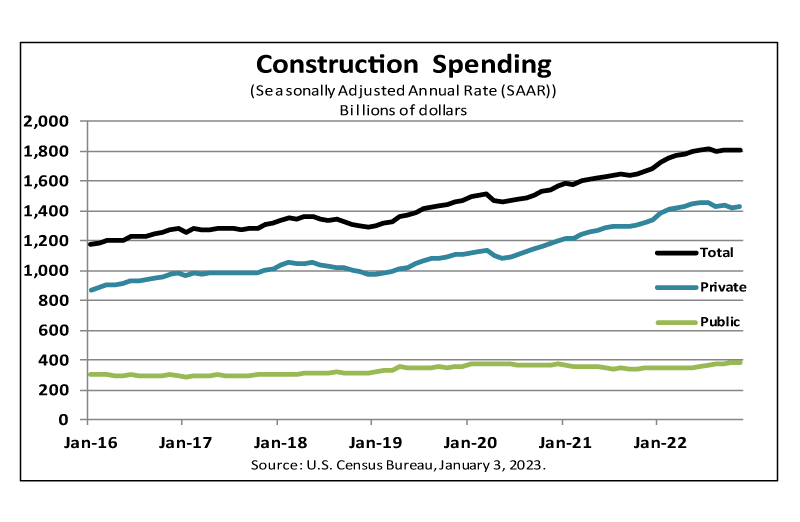

Construction spending recap for 2022

During the first ten months of 2022, total construction spending amounted to $1,507.8 billion, up 10.8 percent from the same period in 2021, according to the latest U.S. Census Bureau construction spending report.

Manufacturing and the smaller water supply market lead all growth sectors in percentage gains, both with 33 percent increases over the nine-month period ending in October, coming in at $111 million and $25 million, respectively.

The Census Bureau reported that the commercial and lodging sectors both saw increases of 22 percent through October over last year while sewage and waste projects saw a 16.6 percent increase. Other percentage gainers were: amusement and recreation, up 12.6; highway and street, up 11.9 and public safety, up 10.7 percent year over year.

The only loser in the nonresidential category the U.S. Census Bureau tracks was power, down 13. 4 percent.

Industry watchers who are cautiously optimistic about the 2023 outlook, point to the backlog data plus the $1 trillion government spending on construction as their foundation for continued growth.

Government spending plan boosts 2023 outlook

The government spending plan includes funding for roads, bridges, ports, rail transit, safe water, the power grid, and broadband internet, among other areas. The Bipartisan Infrastructure law is leading the largest industrial change since the advent of the internal combustion engine. Learn more about how to tap into the funds here.

The law provides $110 billion to repair the country’s highways, bridges, and roads. According to the White House, nearly $40 billion alone will be used for bridges with $39 billion allocated for public transit, an amount that covers transportation systems, zero-emission and low-emission bus purchases and improved accessibility for those with disabilities.

There’s also infrastructure funding breakouts of:

- $66 billion to improve the rail service’s Northeast Corridor and other routes

- $65 billion for broadband access for rural areas, low-income families and tribal communities

- $65 billion to improve the nation’s power grid, which is currently a patchwork of systems

- $25 billion to improve airports, including air control towers

- $55 billion for water and wastewater infrastructure projects

To make the most impact in your community with infrastructure dollars, explore Trimble’s digital project delivery solution.

AIA: Inquires, consensus forecasts point to continued growth

While demand for design services from architecture firms softened considerably in October, inquiries continued to grow, according to the latest report from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for October was 47.7, the first decline in billings since January 2021 (any score below 50 indicates a decline in firm billings). But inquiries into new projects continued to grow in October with a score of 52.3.

“Firm backlogs are healthy and will hopefully provide healthy levels of design activity against fewer new projects entering the pipeline should this weakness persist,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD in a prepared news release detailing the ABI highlights for October, the latest information available.

The ABI Index reported regional averages were pretty consistent across the country with the Midwest posting a 50.8 score, the South, 50.6; and the Northeast at 50.3. Trailing was the West with a slightly lower 49.6 score.

AIA consensus construction forecast

The AIA’s semi-annual consensus construction forecast projects continued growth for 2022 at a robust 9.1 percent for the overall nonresidential market with slightly less growth of 6 percent moving into 2023.

The AIA survey polls the nation’s leading construction economists who forecast business conditions over the next 12–18 months twice a year, January and July. The economists forecast the most growth in the hotel market, at 13 percent.

“The commercial construction market is projected to see mid-single-digit percentage gains both this year and next, spurred by strong growth in the retail and other commercial facilities,” the AIA’s Kermit Baker wrote when releasing the July forecast. “Modest gains in the office sector this year are expected to accelerate a bit in 2023, and the hard-hit hotel sector is finally projected to recover next year.”

Hotel construction outlook

With pandemic restrictions lifted, more consumers traveling, and business travel and trade shows resuming, the big three hotel companies are growing and refreshing their properties. Marriott, Hilton, and InterContinental, which currently dominate the U.S. hotel construction sector, have a combined 3,523 projects and 400,490 rooms in the pipeline.

Continued industrial growth

Supply chain issues, competition for warehouse space, and a renewed focus for onshore manufacturing are driving strong growth of 9.9 percent growth in the industrial sector, according to the AIA survey. This segment is getting an additional boost from the government spending package for infrastructure and the rush to renewable energy, most notable electric vehicles and EV charging stations.

Healthcare construction up

Healthcare construction spending is projected to grow 5.7 percent thanks to a push by medical facilities to expand their services to be closer to the aging population. Growth is also coming from those systems that have deferred maintenance and aging buildings and desire to incorporate new technologies and adjust to major changes in the delivery of healthcare services.

Residential construction spending down

While the nonresidential market is poised for continued growth, the picture is quite different when discussing the residential sector. While the residential housing sector had been a growth area for the past two years, rising interest rates, recession fears and rising inflation have put the brakes on the sector. And because housing is a leading indicator of the health of the economy, this downturn is a concern for the overall economic picture in 2023.

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced declining residential construction numbers for October 2022.

- Building permits were down 2.4 percent below revised September rates and 10 percent over a year ago in October.

- Privately owned housing starts were also down, by 4.2 percent over September and down 8.8 percent from Oct. 2021.

- Privately‐owned housing completions in October were down 6.4 percent below September’s numbers, although they were actually 6.6 percent up over October 2021.

The National Association of Realtors reports that existing home sale prices are declining, and buyers are spooked by the fastest rising interest and mortgage rates in a decade. Low interest rates, some below 3 percent, spurred a boom in home building and buying in the past several years but was abruptly curtailed when the Federal Reserve went on an aggressive rate hike that more than doubled mortgage rates to more than 7 percent.

Because the Fed has indicated it’s not done hiking rates, Realtors and others don’t agree on whether the residential market will see any growth in 2023. But thanks to government spending and a good backlog, the commercial sector looks much stronger and able to weather the rising costs of doing business.

The Ultimate Guide to Construction Cost Management

The construction industry is prone to changes and contingencies that can lead to overspending and waste. This can be crippling for a private business and career-killing for public officials who manage projects with taxpayer dollars.

Managing construction costs isn't just about having the funding and spending it on the right things. It’s also about having the proper cash flow to meet expenses when they arise. There are many places where money is spent, and there are many opportunities for costs to get out of control—especially in our economy today.

Key Topics Covered: infrastructure